Business Insurance in and around Norwalk

Norwalk! Look no further for small business insurance.

Cover all the bases for your small business

Help Protect Your Business With State Farm.

Preparation is key for when something unavoidable happens on your business's property like a staff member getting hurt.

Norwalk! Look no further for small business insurance.

Cover all the bases for your small business

Surprisingly Great Insurance

No one knows what tomorrow will bring—especially in the business world. Since even your most detailed plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your future with coverage like worker's compensation for your employees and a surety or fidelity bond. Fantastic coverage like this is why Norwalk business owners choose State Farm insurance. State Farm agent Greg Obringer can help design a policy for the level of coverage you have in mind. If troubles find you, Greg Obringer can be there to help you file your claim and help your business life go right again.

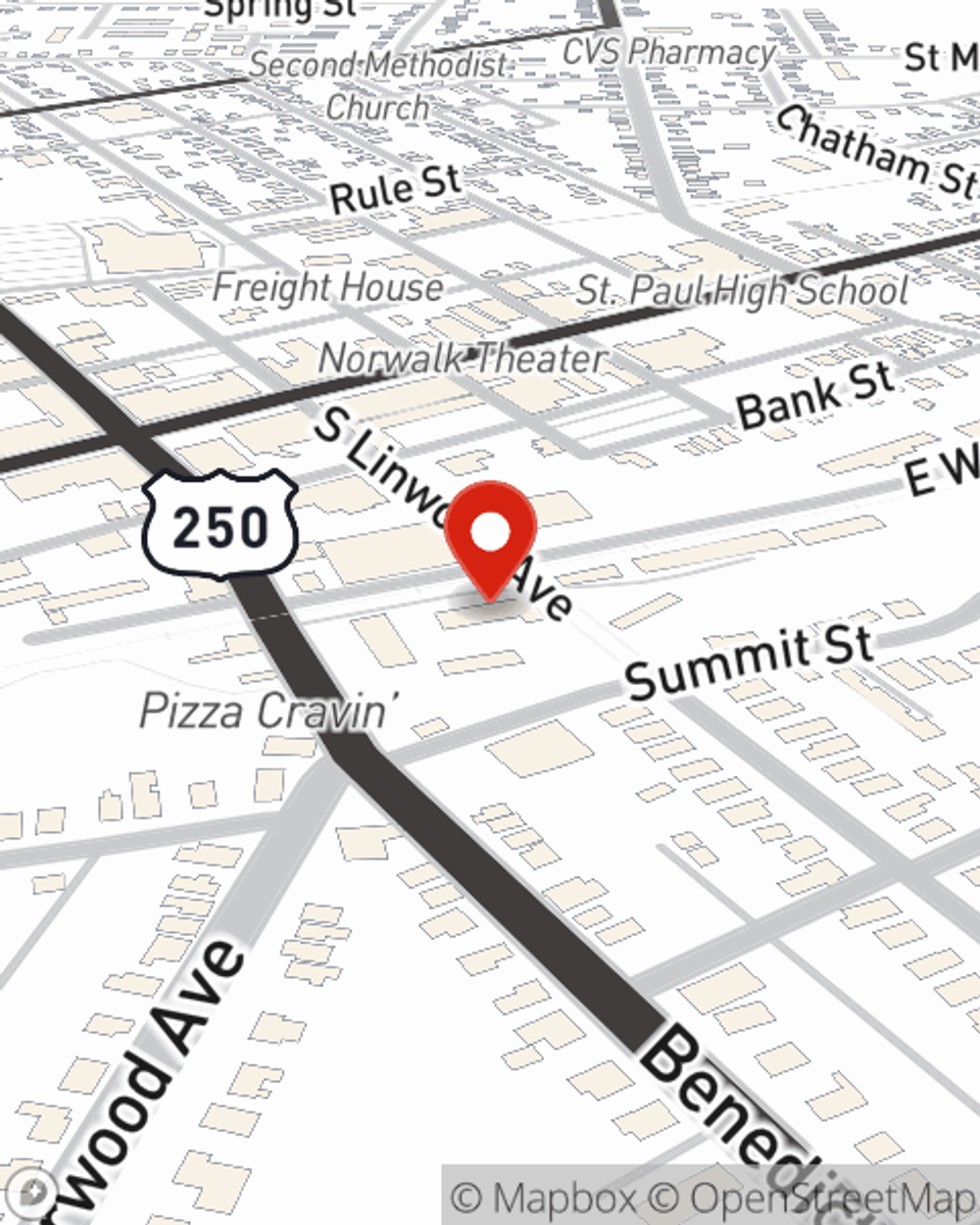

Curious to research the specific options that may be right for you and your small business? Simply get in touch with State Farm agent Greg Obringer today!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Greg Obringer

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.