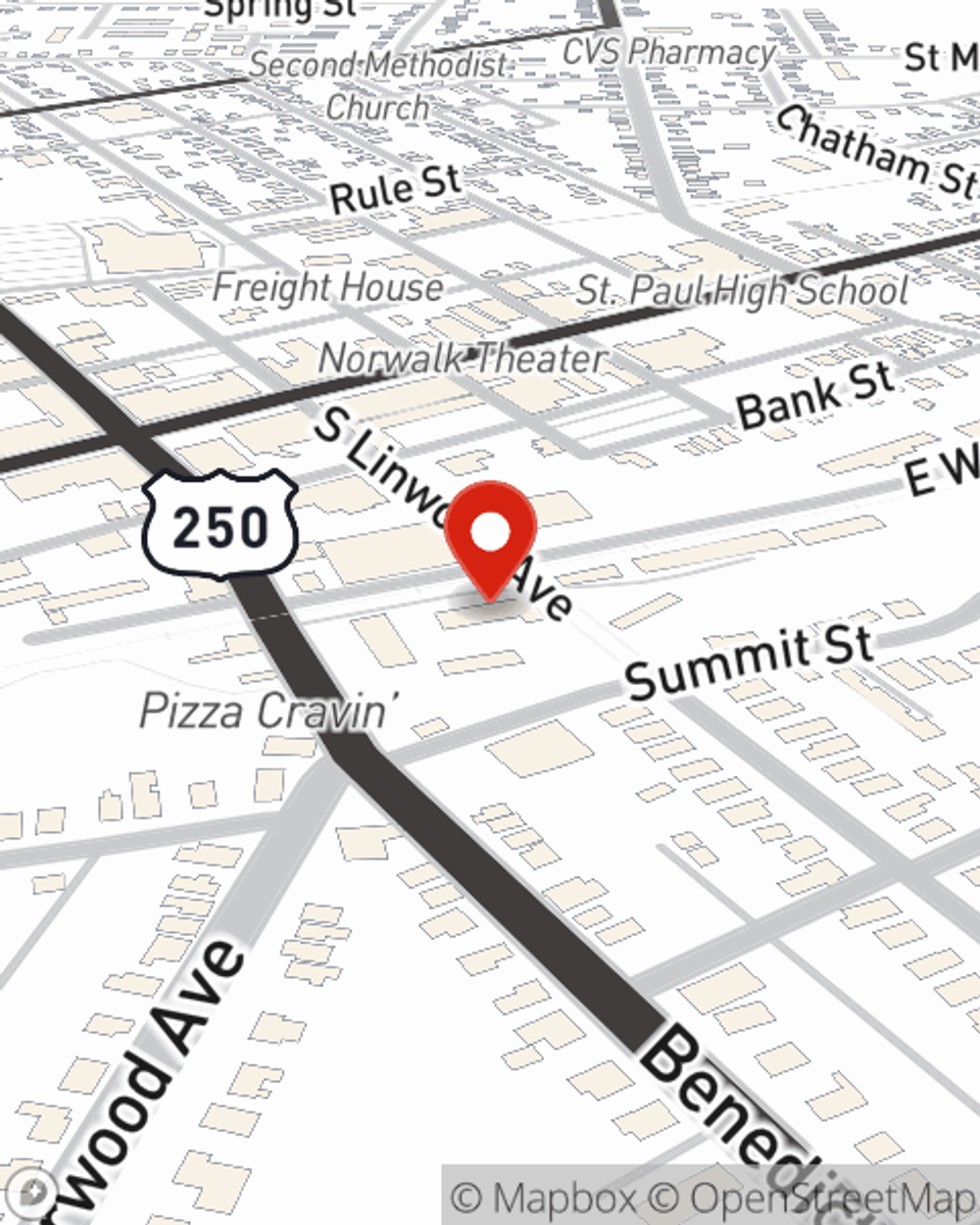

Condo Insurance in and around Norwalk

Townhome owners of Norwalk, State Farm has you covered.

Condo insurance that helps you check all the boxes

Your Search For Condo Insurance Ends With State Farm

Your condo is your home. When you want to laugh and play, wind down and rest, that's where you want to be with the ones you love.

Townhome owners of Norwalk, State Farm has you covered.

Condo insurance that helps you check all the boxes

Condo Unitowners Insurance You Can Count On

You want to protect that meaningful place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as weight of ice or snow, vandalism or lightning. Agent Greg Obringer can help you figure out how much of this fantastic coverage you need and create a policy that has what you need.

Insuring your condo with State Farm can be the right thing to do for your home, your loved ones, and your belongings. Reach out to Greg Obringer's office today to explore how you can save with Condo Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Greg at (419) 660-0172 or visit our FAQ page.

Simple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Greg Obringer

State Farm® Insurance AgentSimple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.